How To Get Law Firm Clients For Your Accounting Practice

Content

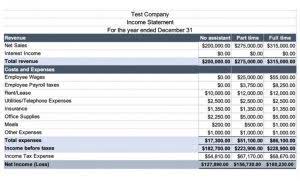

Owners who claim this profile can replace info, boost web optimization, and extra. I actually have a quarterly partner assembly where I take them via the entire P&L.

- Bookstime is specialized in offering services for small businesses, which lets them focus on growth.

- As a top 25 accounting and consulting firm in the nation, Armanino delivers a depth of knowledge, a range of services, and a consistent and responsive team.

- We call this liability “unearned revenue.” Liabilities increase and assets (i.e., cash) increase.

- BooksTime has geared its software to the needs of small businesses and was “designed for business owners.

- Your bookkeeper will compare the balances in your books against bank and credit card statements to see if they match.

- This means they restrict how much money a bank can lend relative to how much capital the bank devotes to its own assets.

Plenty of free options remain in addition to volunteer services and those available to older taxpayers. In other words, you can likely still file for free unless your income is too high. Be sure to check all of the options mentioned here before forking over the cash for tax preparation.

Accounting Vs Bookkeeping

This prevents needing other documents or files when working on your company’s bookkeeping. Prior to establishing an LLC, an entrepreneur must understand how these entities are taxed by the federal and state government.

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site.

- Also, ask them how they handle payments and whether they will be able to conduct all of their services remotely.

- Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

- When you apply for products or services through our links, we may earn a commission.

- If you are considering BooksTime it could also be sensible to check out other subcategories of Accounting Software collected in our database of SaaS software reviews.

- Certain information may bookkeeping be imported; however, you may be required to make an affirmative choice as to how it should be accounted for on your federal tax return.

It’s not a requirement for a sole proprietorship, but it’s still highly recommended. Accounting is especially important to preserve limited liability, which protects personal assets from being seized to satisfy debts and obligations of the business. LLCs are not taxed at the corporate level, which makes them an advantageous choice for many small business owners. Before joining Supporting Strategies, Deserie was Controller of a family-run business with companies in casino management, property management and cold storage. Let your organization thrive through new opportunities around your people strategy and operations and learn how to successfully navigate disruption and transform digitally. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor for both the Online and Desktop products, as well as a CPA with 25 years of experience. He most recently spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll.

Why Do I Need This If I Want To Know How To Start A Bookkeeping Business?

Use of petty cash is sufficiently widespread that vouchers for use in reimbursement are available at any office supply store. Petty cash is a deductible expense; you can take advantage of petty cash by recording it systematically and claim business expenses to reduce business taxes.

Xero integrate with your practice management tool, allowing you to easily track your clients, invoices, and more. You also want to make sure the law firm accounting software you choose is one that integrates with the general ledger package your accountant https://www.bookstime.com/ or bookkeeper uses. This will save hours of data entry time as well as eliminate the possibility of errors. The right legal accounting software gives your staff the tools they need to quickly and efficiently track the time they spend on client tasks.

All Services

Follows established procedures to process purchase orders and invoices, and maintain accounting records. Think of this section as another buffet where a little bit of everthing regarding beginning accounting and bookkeeping is «served». %KEYWORD_VAR% Think of this section as a buffet where a little bit of everthing regarding accounting and bookkeeping is «served». You’ll very likely use Microsoft Excel every single day as a bookkeeper, even if you’re working at a small business.

With a team of experts in business valuations, business transitions, sales and mergers and financial due diligence, we guide our clients at every stage of business. USD accounting majors go on to work at the largest accounting and auditing firms in the world including EY, Deloitte, KPMG and PricewaterhouseCoopers. Additionally, working with a legal accountant to set up your initial payroll—especially when it comes to paying yourself—is the best way to prevent any surprises come tax-season.

Local Bookkeeping Services In Usa

For simple tax returns only; it allows you to file a 1040 and a state return for free, but you can’t itemize or file schedules 1, 2 or 3 of the 1040. When you come to the end of your data-entry chores, BooksTime Deluxe’s final review, called Complete Check, examines your return for accuracy. If you’re looking for a little accounting guidance, or need help with your bookkeeping, budgeting or financial planning, you’re better off working with a CPA. But if you have any issues regarding taxation, Gaddis recommends finding an enrolled agent.

Our online platforms ensure you have full access to the health of your business at all times. She never stops learning and expanding her knowledge of business and personal finance to the benefit of her current and future clients. We collect information related to how you use the Services, including actions you take in your account . We use this information to improve our Services, develop new services and features, and protect our users. Tax deductions – Your bookkeeping data is likely used to prepare your taxes, and therefore helps determine your eligibility for deductions and credits. I offer unmatched client support, and my rates are competitive and clearly defined, so you won’t pay for more than you really need.